Tax-Efficient Corporate Class Investments

Maximize your after-tax returns with strategic corporate class mutual fund investments designed specifically for business owners.

Why MUTUAL FUNDS?

1. Professional Management

When you invest in a mutual fund, your money is managed by a team of experienced financial professionals who (along with their vast team of analysts) conduct extensive research and analysis to select and monitor the fund's securities (stocks, bonds, etc.). This hands-off approach is a significant advantage for individuals who may not have the time, expertise, or desire to actively manage their own portfolio.

2. Diversification

Mutual funds typically invest in a wide range of assets across various companies, industries, and global geographic regions. This diversification helps spread risk, so the poor performance of any single security has a smaller impact on your overall investment than it would with individual stocks.

3. Affordability and Accessibility

Mutual funds generally have relatively low minimum investment requirements, allowing investors to start building a diversified portfolio with modest amounts of money.

4. Liquidity

Mutual funds are highly liquid, meaning you can easily buy or sell your shares on any business day at the fund's closing net asset value (NAV). This provides investors with access to their money when needed.

5. Variety of Choice

There are thousands of different mutual funds available with varying investment objectives, such as long-term growth (equity funds), steady income (bond funds), or a mix of both (balanced funds). This variety allows investors to select funds that align with their specific financial goals, time horizon, and risk tolerance.

6. Convenience and Automatic Investing

Buying mutual funds can be straightforward, and offer many purchasing options such as lump-sum purchases, automatic dividend reinvestment, and systematic investment plans (SIPs), which help enforce a disciplined, long-term investment habit.

7. Regulation and Transparency

Mutual funds are subject to strict regulations designed to protect investors, and fund managers are legally obligated to act in the best interest of shareholders. Funds are required to provide regular updates and detailed information about their holdings, fees, and performance, ensuring a high level of transparency.

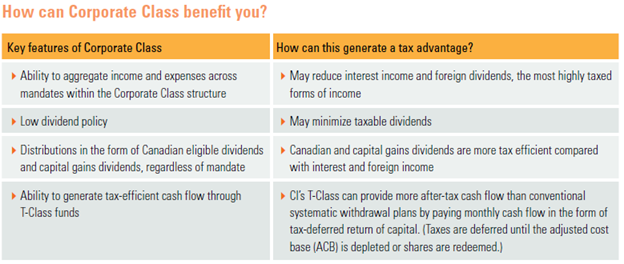

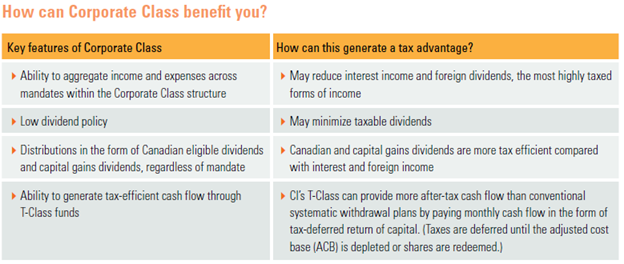

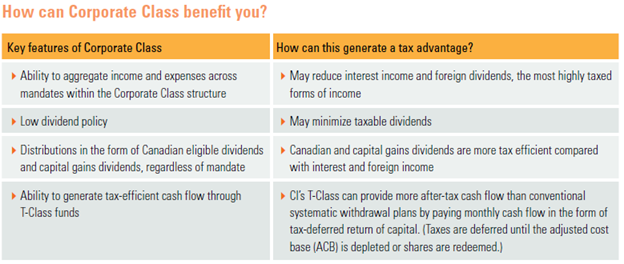

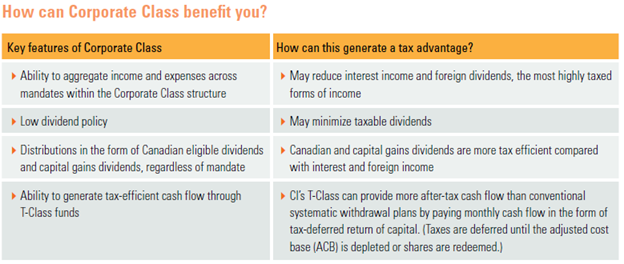

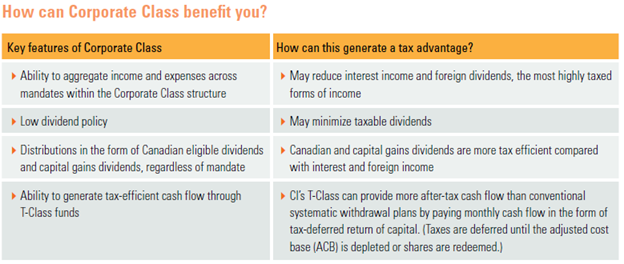

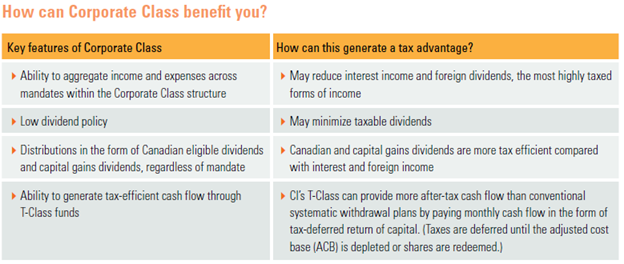

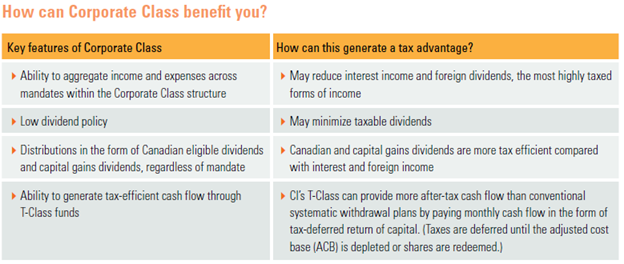

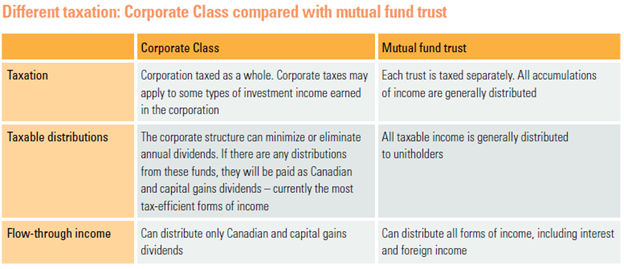

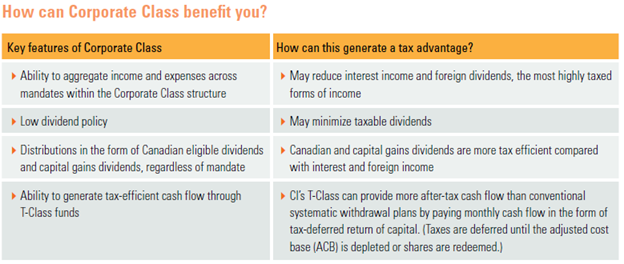

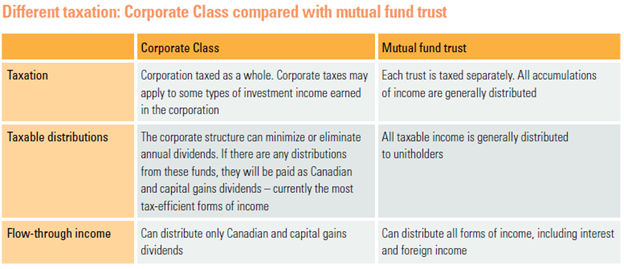

What is a CORPORATE CLASS MUTUAL FUND?

The Corporate Class structure is simply a different structure for mutual funds that can enhance tax efficiencies for non-registered investments. Simply put, they are a regular mutual fund that has been incorporated, and while they will have the same underlying make up of stocks and bonds as it's mutual fund counterpart, it has some very key and important enhanced features that set it apart for Corporate investors.

The benefit of this structure is the potential to minimize annual taxable dividends, allowing the investment to grow further without being eaten away by the annual taxes on the growth. In addition, Corporate Class dividends are in the form of Canadian and capital gains dividends – currently the most tax-efficient sources of income.

As the investment growth in a corporate class mutual fund is deemed to be a blend of capital gains and dividends, you benefit from not only a lower taxation rate on the overall growth earned, but also in the deferring of taxes to later years.

WHO should consider Corporate Class Mutual Funds?

Business Owners!

Corporations are taxed at a flat rate and passive investment income is highly taxed, thus finding tax-efficient sources of investment income is important. Corporate Class dividends are in the form of Canadian and capital gains dividends – currently the most tax-efficient sources of income. In addition, Corporate Class can help fund a corporation's capital dividend account (CDA). This allows the untaxed portion of either capital gains dividends or capital gains on dispositions of Corporate Class shares to pass tax-free from the company to shareholders.

Important: Starting in 2019, incorporated business owners who utilize the small business tax rate may see a reduction in income eligible for this rate when the corporation and its associated corporations earn annual passive investment income in excess of $50,000. The reduced rate will be completely eliminated when the corporation(s) earn passive income in excess of $150,000.

Corporate Class can help reduce this taxable income due to the fact that it has a low dividend payout policy, distributes capital gains dividends that are only 50% taxable and can pay a return of capital distributions (through T-Class).

Educational Video

Here's a great video from one of our main investment partners, Fidelity Investments, on the amazing advantages of using Tax-Efficient Corporate Class Mutual Funds within their company:

Ready to Optimize Your Tax Strategy?

Let's discuss how tax-efficient corporate class investment strategies can help you keep more of your investment returns.

Schedule Your Tax Strategy Consultation