Our 4-Step Financial Planning Process

We follow a structured approach to create comprehensive financial plans that address every aspect of your financial life. Our process ensures accuracy, validity, and maximum benefit for your retirement and legacy goals.

Information Gathering

We begin by collecting and compiling your personal and corporate information. This comprehensive data collection ensures we have a complete picture of your financial situation, goals, and objectives.

- Personal financial statements and tax returns

- Corporate financial records and business plans

- Investment portfolios and asset allocation

- Insurance policies and coverage details

- Estate planning documents and wills

Review of Initial Plan

We carefully review your initial plan to ensure its accuracy and validity. This step helps us understand how things look as "status quo" and identify areas for improvement.

- Comprehensive plan analysis and validation

- Current financial position assessment

- Risk tolerance and capacity evaluation

- Goal alignment and feasibility review

- Tax efficiency and optimization opportunities

Feedback and Recommendations

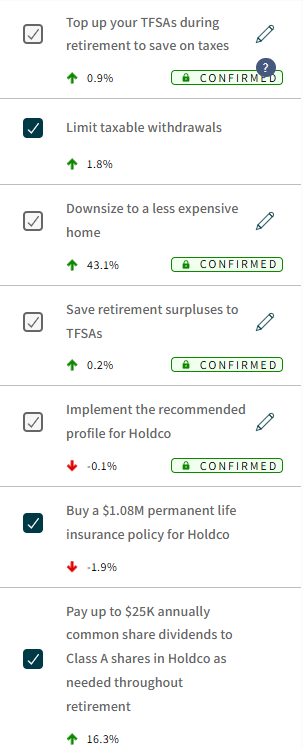

Based on our analysis, we provide detailed feedback and recommendations to further maximize your retirement and legacy goals. Our suggestions are practical, actionable, and tailored to your specific situation.

- Strategic recommendations for improvement

- Retirement planning optimization strategies

- Legacy planning and wealth transfer tactics

- Tax minimization and efficiency strategies

- Risk management and protection recommendations

Team Coordination

We connect with your accounting team to share our findings, feedback, and recommendations. This ensures everyone is on the same page for your elevated and continued success.

- Seamless integration with your accounting team

- Coordinated tax planning and implementation

- Regular communication and progress updates

- Ongoing support and plan adjustments

- Performance monitoring and optimization

Why Choose Our Formal Written Financial Plans?

Our comprehensive approach ensures your financial plan is not just a document, but a living roadmap to your financial success.

Comprehensive Documentation

Every aspect of your financial plan is thoroughly documented, providing clarity and accountability for all stakeholders.

Team Integration

Seamless coordination with your accounting team ensures all professionals are aligned with your financial goals.

Ongoing Optimization

Regular reviews and adjustments ensure your plan evolves with your changing needs and market conditions.

Ready to Create Your Financial Plan?

Let's start the process of creating a comprehensive financial plan that will guide you toward your goals.

Start Your Financial Planning Process